Opinion: Shift Budget gears to 3Cs

Consolidation led by Capex with Commitment to growth can present India as the growth engine of world.

By Anitha Rangan

Hyderabad: After a tumultuous 2022, the Budget event is all set for renewed expectations of hope for every common man. Opinions galore on what the Finance Minister can do to improve our lives, help us earn more and take home more money. In this complex maze of expectations, what can this Budget do differently? How can it accelerate the growth agenda and present India as the growth engine of the world?

Also Read

After three consecutive years of setbacks from ‘uncontrolled’ events, now is the time to shift gears.

Fiscal Consolidation

The first gear is fiscal consolidation to reaffirm economic and financial stability. The pandemic has put the fiscal consolidation road map on a back seat. The last amended FRBM (Fiscal Responsibility and Budget Management) Act targets of 3% fiscal deficit to GDP and 40% central government debt to GDP may not have relevance with 6.4% fiscal deficit to GDP estimate for FY23 along with central government debt to GDP of over 55%. The government had set itself a glide path of 4.5% of the fiscal deficit to GDP by FY26. It is time to revise the medium-term targets and give a clear road map for fiscal consolidation. A road map is important to reinforce the confidence that the government will not spend incessantly, especially on the revenue front. With a call for a cap on subsidies, this road map is critical.

Fiscal consolidation can come from two levers – revenue increase and expenditure rationalisation. With nominal growth (unadjusted for inflation) likely to moderate to 10-12% from high teens, incremental growth in direct tax collections will also moderate alongside. Indirect taxes will be limited to support from domestic activity viz, GST, as any fillip from the external side (viz, Customs) or bounty from an oil price decline (viz, excise) is unlikely. Divestment is, therefore, critical to providing that boost to revenues. Divestment and its long-term vision, especially in areas like non-strategic sectors announced in the FY22 Budget, could be given a structure and direction. A non-ETF (Exchange Traded Fund) route would bring cheer to the capital markets.

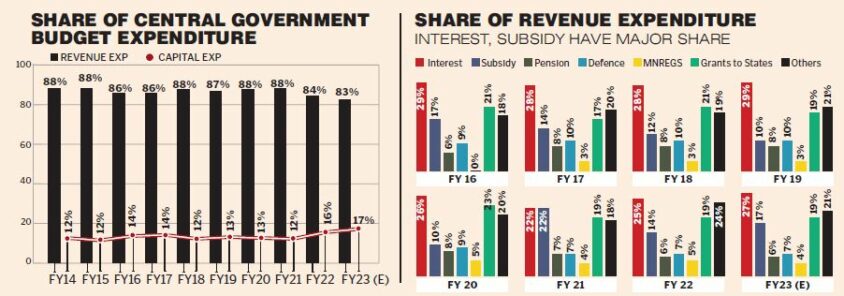

A medium-to-long-term road map on the same is necessary to impart confidence on the consolidation front. Interest and subsidies account for ~45% of the revenue expenditure, grants to States ~19%, with pensions, defence and rural employment ~17%, leaving ~20% for other expenditure. While the reduction in subsidies from discontinuing the pandemic food distribution and thanks to the lowering of global fertilizer prices will support, the scope for rationalisation on the revenue front will come from holding back the impulse to any increase in expenditures. (See figures). Fiscal consolidation from revenue expenditure rationalisation and revenue growth from tax and non-tax revenue should be the way forward.

Capital Expenditure

That brings us to the next lever – Capital expenditure – to take us to the $5-trillion economy. A rupee of capital spend has a potential GDP multiplier of ~3.25 times while revenue expenditure is less than 1. In the last two years, the government has pressed its foot on the capex, increasing the share of capex expenditure in overall expenditure. From FY09 to FY21, the average capex to GDP ratio was 1.8%, which was revived to 2.2% and 2.5% in FY22 and FY23 and further expected at ~3.1% for FY24. The best ratio seen within the last two decades was in the high growth era of FY04 and FY05 between 3.5% and 3.8%. Surely, we intend to cross that. Spending focus will be on railways, roads and defence, and encouraging States to spend as well.

Notably, the PLI (Production Linked Incentive Scheme) launched in the FY22 Budget, has been met with success with the Rs 2-lakh-crore of capex implementation within 13 sectors already ongoing. There is an expectation that more sectors will be added to this scheme which has the potential to boost revenues, alongside jobs, scaling up exports and reducing import dependency. Overall, the government will clearly intend to boost capex not just from its own resources but also by encouraging private capex. The States will also be nudged to support.

Commitment

That takes us to the third lever – Commitment to delivering the stated objectives in parts and whole. While the government’s intent to deliver on its promises is strong, compromise on certain areas like divestment, subsidies and a slowdown in the pace of execution, especially capital spending (including States) is visible. The headlines and the intent have always been compelling. The execution is what has been wanting.

Conservatism

The other ‘C’ that we want the government to shed is conservatism. The Budget estimates on the revenue side for FY23 were all coated with conservatism from the word go. In comparison to the actual of FY22, the estimated gross tax revenue was just ~2%. With a focus on transparency in other areas over the last few years (off-balance sheet, subsidies, etc), expect this Budget to be more balanced in terms of both revenue and expenditure. Only then will the performance be assessed correctly. If commitment were to be demonstrated, conservatism has to be shed. From ‘under promise and deliver’, the stride could turn to ‘promise and deliver.’

Any scheme under the Budget around tax rationalisation of direct or indirect taxes, hiking tax exemption limits, export incentives, infrastructure sops and climate change initiatives will fit into one of these pillars.

Growth is the beneficiary of all three levers. These levers work in tandem. If capex will provide a boost to growth, then fiscal consolidation is necessary. Otherwise, government borrowing will crowd out private capex funding. In addition, fiscal consolidation is also necessary to keep medium-to-long-term inflation under check. The government’s aim should be to increase capex spending to 4-5% of the GDP over the next few years, even crossing the early 2000 era. That will put India on a growth path of over 7%.

Fiscal consolidation will ensure that borrowing rates (both domestic and external viz, India’s credit risk spread) will then remain optimum which will, in turn, support capex funding. A broad-based capex supported by demand will need funding support. If the government is pushing PLI with one hand, the other hand needs to balance out its borrowing as well. Commitment to deliver needs to be echoed at all times. All of this translates into growth. Despite external headwinds, domestic growth is holding up well. External headwinds, while not in control, have been balanced well by policymakers over the last three years. The Budget statement will reaffirm that India’s fundamentals will remain strong.

India is the shining star amidst shallow global growth. This is the moment for India to capture and showcase a structural plan. Focusing on the first three gears can easily move the economy into auto-gear of the fourth and fifth steps. Consolidation led by capex with a commitment to growth could present India as the growth engine of the world. This Budget is all about shifting gears to accelerate growth!

Related News

-

Telangana’s capital expenditure turns regressive under Congress regime

-

Khammam: Newly posted constables told to serve public with commitment

-

Andhra Pradesh govt presents Rs 2.94 lakh crore Budget, aims at restarting State’s financial wheels

-

Telangana BC Commission holds public meeting; asks stakeholders to participate in caste census

-

Save future of Telangana NEET PG aspirants, IMA writes to CM Revanth Reddy

10 mins ago -

Telangana techie loses Rs 4.15 lakh to online gold trading fraud

39 mins ago -

Hyderabad: Couple working as house help at doctor’s residence held for theft

55 mins ago -

Hyderabad auto driver foils attempt to kidnap young woman, five held

2 hours ago -

Haiti gang attack on journalists covering hospital reopening leaves 2 dead, several wounded

3 hours ago -

21 dead as Mozambique erupts in violence after election court ruling

3 hours ago -

Cartoon Today on December 25, 2024

11 hours ago -

Sandhya Theatre stampede case: Allu Arjun questioned for 3 hours by Chikkadpallly police

11 hours ago