Rewind: Debt that’s good; Telangana can repay its debt, easily

The debt of every citizen in Telangana is fully sustainable even for the next generation given the durable assets the State has created to power growth

By B Yerram Raju

Let’s begin with a small example. Raghav joined a bank and Venkataiah a software firm. The first salary slip arrived. Their fathers’ loans for their education needed repayment. The bank and the firm offered a plethora of loans and another bank offered a credit card with a limit of Rs 2 lakh. There is a loan for scooter, a house, consumables, loan on jewellery, a loan from provident fund, pension fund, and from the Employees’ Credit Cooperative Society to meet the margin money on loans as years roll off. Life of both became comfortable with all the loans as this debt was being repaid through a direct cut in the salary. Institutions permit such debt up to 25% of their gross salary. So far so good. As their families expanded, the ability to pay loans diminished and hence, the need for more debt. The limits to growth had to be ordained by the ability to borrow.

Also Read

Individuals and nations sail in the same boat. Sustainability of the debt and resilience of the individual or nation surface as essential drivers of further growth.

While the fears of the pandemic have abated, global uncertainties amid heightened inflationary pressures, the Ukraine-Russia war and oil crisis still haunt us. Union Finance Minister Nirmala Sitharaman unequivocally said the Indian economy continues to be restive and watchful notwithstanding the financial stability and sustainability.

With unemployment and headline inflation (total inflation including food and energy prices) still above the RBI norm, there is little room for monetary policy intervention through any interest rate cut to drive further growth. The International Monetary Fund (IMF), World Bank, rating agencies and the Reserve Bank of India (RBI) have pegged the current year’s growth rate in the range of 6.1-6.3% and for FY25 at 6.5%. This is well below the 10% growth a decade ago in 2012. Economists estimate we would reach 8% by 2029. This would naturally put pressure on fiscal policy that relies more on public debt.

From nations, which borrow from the IMF or ADB or other global lender, to individuals and corporations who borrow from banks and financial institutions, all ask for loan write-offs under one score or the other. The latest reason for nations seeking write-offs is the huge investments they have committed to reduce carbon emissions under COP 26. In India, with the general elections round the corner, political parties under competitive populism aggressively promise debt write-offs for the farmers because they constitute a large number in the vote bank. However, every loan, irrespective of who gives it, carries with it conditions. This article looks at such sovereign debt from the point of view of relevance and reverence.

Debt can be simply understood as the amount owed by the borrower to the lender. The total financial obligations of the public sector make up a nation’s gross government debt, also known as public debt or sovereign debt. Debt products include bonds, Certificates of Deposit, Commercial Papers, Debentures, National Savings Certificates and Government Securities.

India’s debt market is one of the largest in Asia and broadly consists of government securities (G-Secs), including central and State government securities, and bonds issued by corporations

No government, State, or Union can afford to be free from debt since governments have the responsibility for huge infrastructure investments, apart from those in productive and social sectors. The limits for borrowing are set in India by the FRBM (Fiscal Responsibility and Budget Management) guidelines and to a certain extent by the Finance Commission, a constitutionally appointed body whose term usually extends for five years since its acceptance by Parliament. War, pandemic, etc, demand far higher expenditures than the budgeted deficit.

Debt-to-GDP Ratio

This ratio is an economic metric that compares a country’s government debt to its GDP, which represents the value of all goods and services produced in the country. This is the barometer for determining the stability and health of a nation’s economy. Oversized debt ratios above 77% could affect economic growth adversely and increase the default risk. The Indian economy is on the threshold of 65% of GDP, well below many developed nations that include the US, China, Russia, Japan, Canada, UK, Italy, and those in Europe ranging close to 80% of GDP. Right policies should be the barometer for incurring higher debt-to-GDP ratio.

The Union government made extravagant claims that it would double farmers’ income in five years. Despite annual increases in the budgetary allocations under irrigation and cash roll-out of Rs 6,000 in three instalments into the farmer’s account as a direct benefit, the income of the farmer is crawling and not doubling. Investment credit to the farmers too has not shown any increase over the years. Banks, however, exceed the target for crop loans set in the Budget announcement. This does not flow from the Budget. But if such loans are to be written off, the Union or the States that announce such write-offs should bear the brunt of it. How do they meet this? By public debt, of course.

According to Harvard economists Jason Furman and Larry Summers, the fear that government debt is discouraging private investment is based on an “absurd diagnosis of today’s economic problems”

Recalling the Economist May 16, 2019, issue is in order. The article, ‘Economists are rethinking fiscal policy,’ warned that the US public debt would reach the unsustainable level of 92% of GDP by 2029. It is already close to this figure even by the end of this fiscal. According to Harvard economists Jason Furman and Larry Summers, the fear that government debt is discouraging private investment is based on an “absurd diagnosis of today’s economic problems”.

The conclusion holds good even today. It may be harder to find economists who back harsh austerity to shrink debts, rather than merely to contain them. Few of today’s politicians display much of an appetite for belt-tightening. “In an age of populism, unfunded tax cuts and the Green New Deal… balance between tax and spending will probably land them on the hawkish side,” the Economist stated. Winning elections matters more than deficits! Everyone loves debt and its write-off too!

Telangana can repay its debt, easily

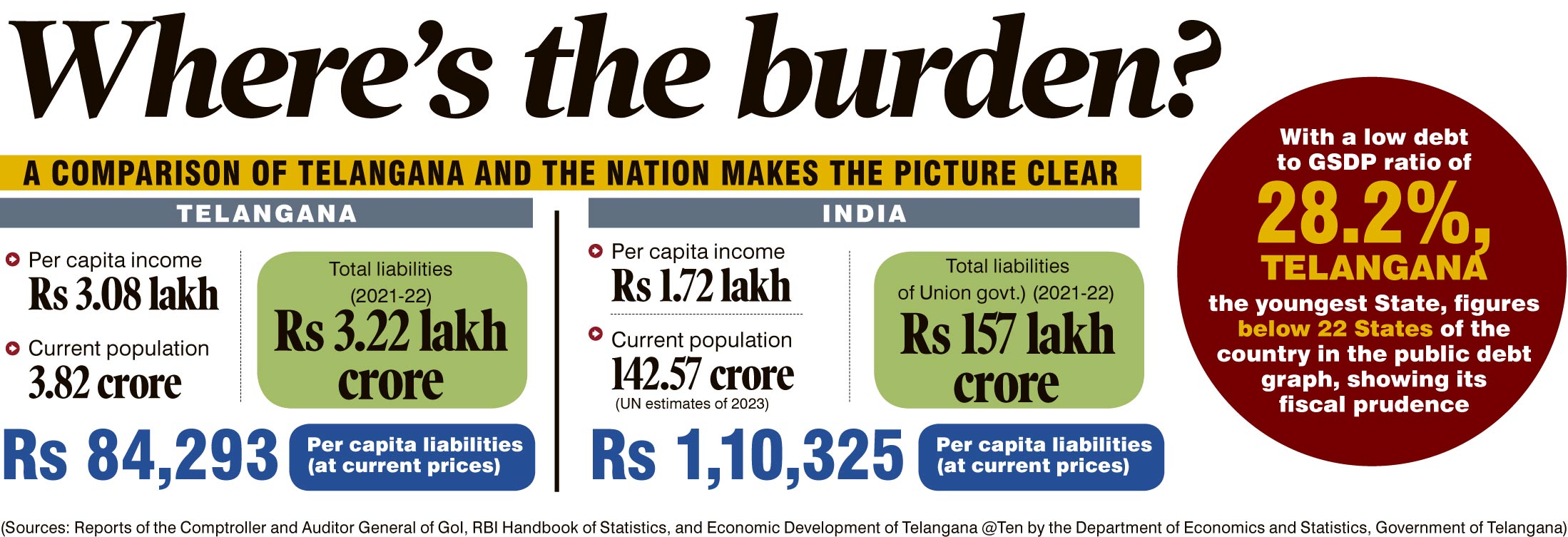

If the per capita income is higher than public debt in any State, particularly in the context of such public debt creating enduring assets (assets that have the propensity to raise the incomes of a large section of the population, like the farmers), then it would mean that the debt is well within the repaying capacity of the people. The Telangana government stands out uniquely in this regard with the per capita income at Rs 3.08 lakh, as against the country’s Rs 1,72,000.

The State has a population of 3.82 crore. The total outstanding debt of the State stood at Rs 2,83,452 crore at the end of 2021-22 when the population was 3.5 crore. According to the CAG report, the total liabilities of the State stood at Rs 3.22 lakh crore by 2021-22. If we consider the total liabilities as the future debt of the citizens of Telangana, the liabilities of every citizen at current prices would be Rs 84,293 (present population divided by total liabilities). We take the present population to arrive at the per capita income because the debt of the present has to be paid at a future date and perhaps by the next generation!

Durable assets have been created in the State, particularly in the farm sector — agriculture and allied activities — on which 46% of the State’s population relies. This made Telangana look like the coastal districts of neighbouring Andhra Pradesh that have copious rains and live rivers of Godavari, Krishna, and rainfall-dependent Vamsadhara, and Swarnamukhi exist.

The Kaleshwaram Lift Irrigation Project and the Mission Kakatiya, which has brought to life some 40,000–odd tanks, provided assured irrigation and improved the soil status. Drought-prone Mahbubnagar with the highest labour out-migration turned wet with the Palamuru Lift Irrigation scheme, coupled with assured income for the social groups depending on cattle, goats, fish, etc. Schemes like Rythu Bandhu are putting incomes in the hands of the farmers, and have enhanced the value of land in Telangana like never before. Gross irrigated area has significantly increased by 116% —from 62.48 lakh acres in 2014-15 to 135 lakh acres in 2021-22. This is a tangible asset.

When durable assets are created with public debt, the debt is sustainable. Farmers have cash in their hands when they actually need it, ie, at the time of preparing the soil or sowing the seed, because, at that point, their harvested crop would either be in the soil or silo. Any accident in the field is covered by Rythu Bima for Rs 5 lakh. This is not crop insurance. But the State has a procurement policy to pick up all the grain produced. This became possible not with just the income from taxes and duties or share in the divisible pool of taxes, but through public debt.

Copious water, responsible advisory services through 2,500 agricultural extension officers and advice through mobile from the Professor Jayashankar Telangana State Agricultural University, (PJTSAU) made the debt sustainable. Yet, where was the need for loan write-off? Farmers’ debt is perpetual in nature. The debt hanging on them was inherited and that led to suicides. To prevent any such happening and to remove the perpetuity as well as to address competitive populism in the slogan for write-off, Telangana took the write-off route to the tune of Rs 14 lakh crore. This huge write-off again became possible through the public debt. This took the share of GSVA (Gross State Value added) to 18.8% in 2021-22 from 16% in 2014-15.

Yet, in the area of public debt, this youngest State finds 22 States above it in the public debt graph with low debt-to-GSDP ratio of 28.2%, showing its fiscal prudence. “The notable growth of the economy resulted in a tremendous increase in the resource pool of the state (State Own Tax Revenue). The revenue of the state expanded from Rs 29,288 crore in 2014-15 to Rs 1,06,949 crore in 2022-23 — an increase of more than 265%.”

The debt of every citizen in Telangana is sustainable for the next generation presuming that there would be no deterioration in the durable assets it created and the phenomenal, acknowledged growth in the real estate, industry, and services sectors during the last nine-and-a-half years.

Related News

-

KCR extends Christmas wishes to people of Telangana

-

Telangana’s micro-sculptor Ajay Kumar sculpts Brazil’s “Christ the Redeemer” in the eye of a needle

-

Leopard spotted and panic prevailing in Nandipahad village under Maddur mandal

-

Unpaid loans: DCCB erects auction flexis in farmers’ fields in Kamareddy

-

Cartoon Today on December 25, 2024

7 hours ago -

Sandhya Theatre stampede case: Allu Arjun questioned for 3 hours by Chikkadpallly police

8 hours ago -

Telangana: TRSMA pitches for 15% school fee hike and Right to Fee Collection Act

8 hours ago -

Former Home Secretary Ajay Kumar Bhalla appointed Manipur Governor, Kerala Governor shifted to Bihar

8 hours ago -

Hyderabad: Organs of 74-year-old man donated as part of Jeevandan

8 hours ago -

Opinion: The China factor in India-Nepal relations

9 hours ago -

Editorial: Modi’s Kuwait outreach

9 hours ago -

Telangana HC suspends orders against KCR and Harish Rao

9 hours ago